Life Insurance coverage Is Necessary

For many of us, having some type of life insurance coverage protection could be a accountable factor to do. It’s extra essential ought to we’ve relations like our kids, dad and mom or partner who depend on our revenue.

There are two foremost types of life insurance coverage. Entire Life Insurance coverage and Time period Insurance coverage.

Time period Insurance coverage

Time period insurance coverage is a less expensive type of life insurance coverage in comparison with entire life insurance coverage. Additionally it is simpler to know. You inform the insurance coverage firm how a lot protection you need, and for the way lengthy. They quote you a value for the protection, relying in your age and medical historical past.

You obtain a payout provided that one thing unhealthy occurs in the course of the period of the protection, whereas the insurance coverage is in impact.

Learn Additionally: Why You Ought to Purchase Time period And Make investments The Relaxation

Entire Life Insurance coverage – Pay A Restricted Interval, However Take pleasure in Protection For Life

One of many key worth propositions for entire life insurance coverage is the premium cost for a selected time interval, with lifetime protection.

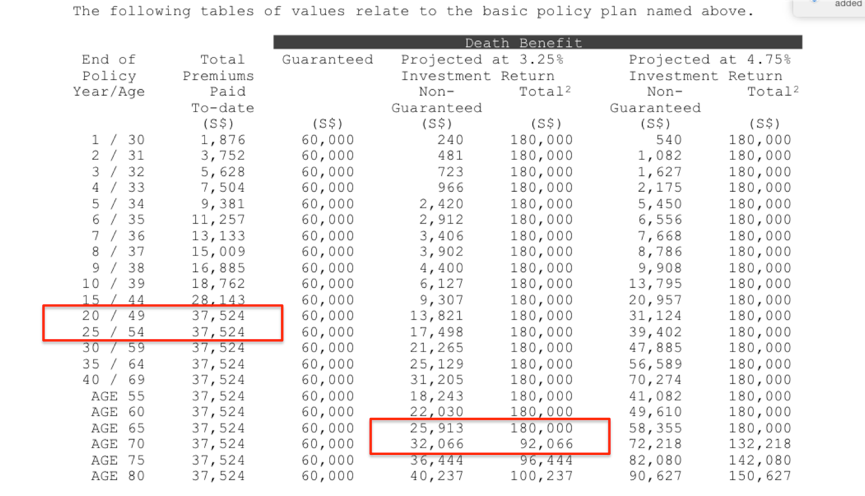

Coverage Assumptions: 29 12 months previous feminine, non-smoker

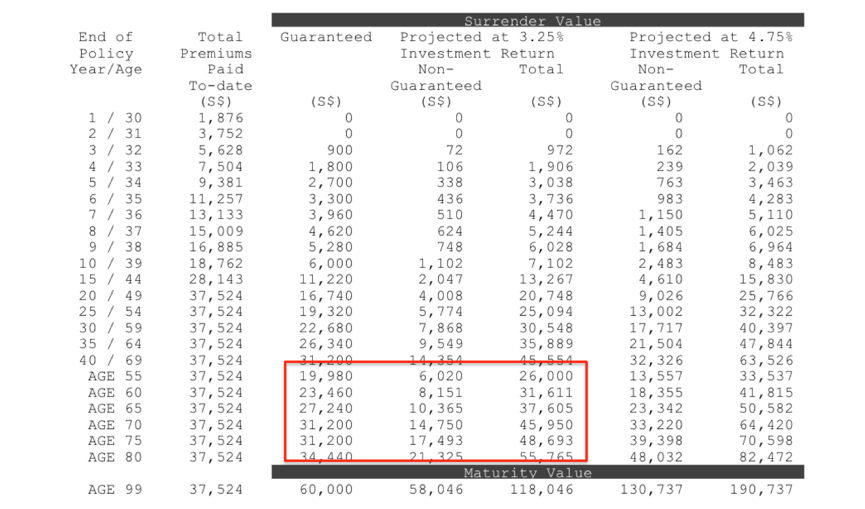

The policyholder pays a premium of $1,876 annually in return for assured life insurance coverage protection of $60,000. This appears costly, however there are some factors price noting.

#1 You Pay For 20 Years

We see from the demise profit illustration above that complete premiums paid to-date cease rising from 12 months 20 onwards. It is because the coverage solely requires cost for the primary 20 years.

#2 Multiplier Impact 3X Earlier than Age 70

Despite the fact that the sum assured is $60,000, the coverage truly supplies a assured 3X demise profit payout earlier than the age of 70. So demise profit protection is definitely $180,000, earlier than the age of 70.

Entire Life Insurance coverage – Money Give up Worth

The opposite worth proposition that makes a complete life insurance coverage engaging is the money worth element that such insurance policies include. If policyholder decides at any time limit to give up the coverage, they might obtain the money give up worth element of the coverage.

The give up worth is decided by two elements. The insurance coverage firm ensures the “Assured” portion. There may be additionally a “Non-Assured” portion decided by way of the funding returns that the insurance coverage firm earns.

For instance, if at age 70, the policyholder decides to give up the coverage, the insurance coverage firm would offer a assured payout of $31,200.

Assuming the funding return is at 3.25% per 12 months, there could be a non-guaranteed payout of $14,750. In complete, the policyholder would obtain $45,950.

There are 2 issues you might want to bear in mind about money give up worth:

#1 The Projected Funding Return Is NOT Your Return

If you’re not good with numbers, you is likely to be forgiven for assuming {that a} 3.25% return is what you will get from this plan. It’s possible you’ll suppose that with the ability to purchase a coverage that gives insurance coverage and a 3.25% annual return seems like an excellent deal. However there are elementary flaws with the argument.

Firstly, the return is NOT assured. The insurance coverage firm solely wants to ensure you the “assured” portion, which is $31,200.

Secondly, the three.25% is NOT your return. The illustration is saying how a lot you’re going to get IF the projected return reaches 3.25% each year.

After we did the maths, getting $45,950 after a 40-year interval primarily based on the construction of how the premium is paid, it provides us a return nearer to 0.7% each year. Ouch.

To be honest, a part of the explanation why the returns are low is as a result of we’re excluding the insurance coverage value, which is included as a part of the premium.

#2 Demise Profit Does Not Equal Give up Worth

When you examine the 2 tables above, give up worth is at all times decrease than demise profit, even after the age of 70, when the multiplier impact for demise profit is not in place.

Age

Demise Profit

Give up Profit 70 $92,066 $45,950 75 $96,444 $48,693 80 $100,237 $55,765

* Assumption that funding returns are projected at 3.25% each year

** Earlier than the age of 70, demise profit is $180,000, as a consequence of 3X multiplier impact

Our Ideas

Because of the restricted pay interval, policyholders ought to count on to pay extra for a complete life insurance coverage plan in comparison with a time period plan. That is for the perks of getting a complete life protection (until age 99), and the money give up element. As customers, we get what we pay for.

In our opinion, the primary precedence is to make sure that your life insurance coverage coverage provides you precisely what you want it for, and that’s, ample protection for you and your loved ones within the occasion that one thing occurs.

Secondly, affordability performs an element as nicely. We have to steadiness our insurance coverage wants with different monetary objectives similar to financial savings and investing. It’s pointless to be paying a lot for a life insurance coverage plan, solely to appreciate that you simply should not have sufficient left in your funding and saving objectives.

Final however not least, we predict it’s best to keep away from treating your entire life insurance coverage as a saving or funding plan. It’s neither. As a saving plan, the coverage supplies little or no liquidity, since any give up of the plan earlier than the age of 70 is prone to end in a “loss” from the premium paid.

From an funding perspective, the returns are hardly ample to justify it as an environment friendly allocation of funds. Furthermore, you get no management over the kind of investments you want to make.

This doesn’t imply that a complete life insurance coverage plan doesn’t have a spot in our monetary planning portfolio. As a life insurance coverage coverage, it affords protection for all times. The multiplier impact provides you added protection if you find yourself younger. The money give up worth provides us possibility sooner or later to money in throughout our previous age.

Learn Additionally: How To Perceive A Entire Life Insurance coverage Coverage