Solomon stated, about 4,000 years in the past, that there was nothing new below the solar. I believe he was proper. Largely we rehash previous info and faux it’s new. We do make some new discoveries, however for essentially the most half, monetary concepts haven’t modified since his time.

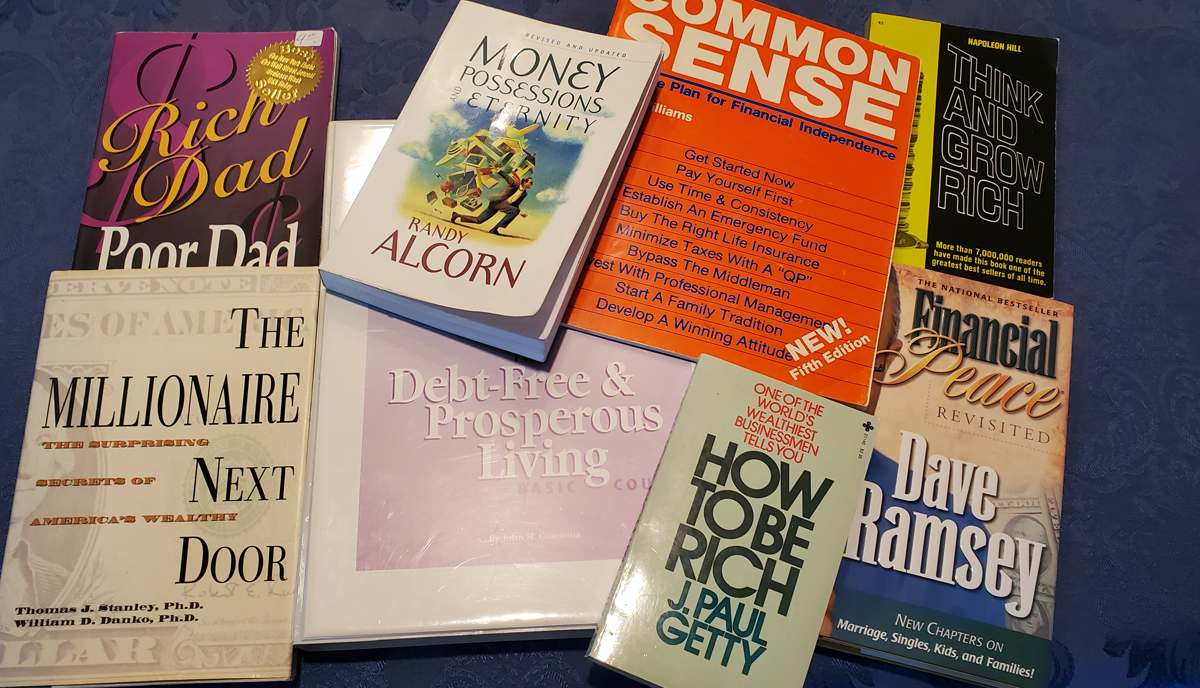

Within the Nineteen Eighties whereas in medical college, I started learning private finance. That’s after I selected age 50 as my goal retirement date. At the moment there was numerous nice monetary info accessible that wasn’t any completely different than what’s being taught at present. Let’s check out a publication I nonetheless preserve helpful in my workplace e-book shelf with a copyright date of 1983.

Following is a listing of the primary 7 ideas coated on this publication. Discover that these matters are precisely the identical matters that individuals are calling new and wonderful monetary methods at present, and that these methods weren’t taught to docs again then.

1: Get Began Now

2: Pay Your self First

3: Use Time and Consistency

4: Set up an Emergency Fund

5: Purchase the Proper Life Insurance coverage

6: Decrease Taxes with “Certified Plans”

7: Bypass the Intermediary

Is there something on that listing that appears like a novel new method to finance?

Whereas in medical college, earlier than there was an web, I had already discovered this info and formulated my plan. I didn’t like borrowing cash to go to high school, therefore I joined the Navy so they might pay for medical college. After I acquired married throughout my internship, my spouse and I made a decision to reside on half of our mixed earnings. The money owed I amassed after beginning my apply acquired paid off early utilizing a modified snowball technique. I started funding my retirement by means of IRAs and a deferred compensation plan in January of 1989 as an intern, which was my first full time job. I adopted my plan and hit my goal of economic independence by age 50. I reduce to half time after which absolutely retired from medication at age 54.

Info on the proper strategy to do finance has been round for a very long time. We wanted solely to search for it.

-King Solomon wrote about it 4,000 years in the past. (There may be nothing new below the solar – Ecclesiastes 1:9.)

-Napoleon Hill printed Suppose and Develop Wealthy in 1937 (It acquired me considering.)

-J. Paul Getty printed How one can be Wealthy in 1965 (Extra good considering.)

-Larry Burkett based Christian Monetary Ministries (Later Crown Monetary Ministries wherein my spouse and I had been instructors.) in 1976 to show individuals private finance in small group discussions.

-Artwork Williams Printed Frequent Sense: A Easy Plan for Monetary Independence in 1983 (That is the publication I referenced originally of this text. This e-book is accountable for the plan I laid out throughout medical college that had me financially unbiased by age 50.)

-Charles Givens printed Wealth With out Danger in 1988 (I attended certainly one of his reside conferences and took his course throughout residency. His concepts helped me handle my very own retirement funds.)

-Randy Alcorn printed Cash Possessions and Eternity in 1989 (The Bible’s tackle cash.)

-John Cummuta printed Debt Free and Affluent Residing in 1991 (This is the reason I turned debt free.)

-Dave Ramsey Began Monetary Peace College in 1994 (Retooled the Crown message.)

-Stanley and Danko printed The Millionaire Subsequent Door in 1996 (Very inspiring to be taught I used to be a millionaire subsequent door.)

-Robert Kiyosaki printed Wealthy Dad, Poor Dad in 1997 (Helped push me into actual property investing)

-I began my Docs Information Sequence in 2016 (It helped a number of you attain your objectives.)

The books on this listing simply scratch the floor of the monetary books I’ve learn. I’m not listening to any new ideas being taught at present that haven’t been round for a very long time. There are, nonetheless, some new methods of the commerce, just like the backdoor Roth IRA which turned attainable in 2010, but it surely actually continues to be simply an IRA, which began in 1974. I used to be capable of navigate my strategy to retirement with out utilizing a Roth product.

Prior to now, docs weren’t as involved with their private finance as a result of they made a lot cash they may afford to be sloppy with their cash. Now they nonetheless make some huge cash, however their elevated pupil mortgage debt is haunting them, so that they have elevated their efforts to amass information on funds. It’s true, this isn’t, and doubtless shouldn’t be, part of medical coaching. There may be a lot to be taught and simply not sufficient time to show the data wanted to be a very good physician, so I doubt monetary educating will ever be part of the majority of medical coaching establishments. Though some medical faculties have began to show finance to their college students.

Private finance info is far more accessible now with the web than it was after I was first studying. I wanted to go to the bookstore to purchase a finance e-book. I additionally subscribed to some monetary newsletters and magazines which arrived in my mailbox as soon as a month. At this time, I can Google the identical info and have it at my fingertips in a second. I can even obtain a brand new e-book on my Kindle and begin studying with out even leaving my desk.

Now there are dozens of blogs geared toward educating private finance to physicians. I began my enterprise as a result of I felt that docs weren’t catching on to the mainstream monetary teachings. For the reason that mainstream numbers had been geared for the common earner, excessive earners had the mistaken assumption the data didn’t pertain to them.

After I taught Crown Monetary Courses, or talked about monetary matters within the docs’ lounge, or over an operation, I observed the data was going proper over the docs’ heads. After I talked about changing into debt free, docs would say that it might work for his or her nurse, however as a physician, their debt was approach too excessive to get all of it paid off shortly. This after all was not true, as the quantity of debt you may tolerate is proportional to your earnings.

So I began educating with greater numbers in thoughts. Docs don’t get enthusiastic about an individual who simply paid off their $50,000 debt, when their very own debt is $550,000. However after I inform them I paid off greater than $500,000 in lower than six years, they will’t say it doesn’t pertain to them. After they discover out I did it, they will relate.

After I started publishing my award profitable/best-selling Docs Information collection of books, docs might relate to the examples within the e-book as a result of the books are geared to the higher earnings earners. I used to be certainly one of them. If I might remove my debt and retire in my 50s with a really good way of life, then so might they. It appeared I simply wanted to repackage the previous info and inform docs it was geared for his or her earnings degree. However the actuality is, the ideas are the identical. Changing into debt free is the very same course of at each earnings degree. There are simply extra zeros concerned.

Is a physician actually in a special state of affairs when she will’t make her airplane cost, then when her nurse can’t make his trip house cost? Not likely. They’re each spending greater than they make and it’s coming again to hang-out them.

Ron Blue stated it finest:

“Spend lower than you make, make investments the distinction, and do it for a protracted time period.”

It truly is that easy, however we docs are inclined to make issues extra advanced.

If you’re having hassle making it easy, then learn certainly one of my books on the subject you need assistance with or contact me for one-on-one assist and I’ll show you how to see the simplicity of cash. You bought this. It’s not new. If different individuals have been doing this for many years, so are you able to. So begin getting your funds so as at present.

Share this text: