This sum of cash can be significantly vital on your family members who will now not be capable to have the monetary assist that you just present for them. The insurance coverage payout from a time period life plan will be sure that your family members will be capable to proceed residing their lives with minimal disruption to their way of life.

Finite Time period Life Insurance coverage Protection

As its title suggests, time period life insurance policy give you life insurance coverage protection for a hard and fast time period. Within the occasion that loss of life, complete and everlasting incapacity or terminal sickness happens throughout this era, the sum assured can be paid out.

Within the (lucky) occasion that loss of life, complete and everlasting incapacity or terminal sickness doesn’t happen throughout the insured interval, the coverage expires with no payout being made.

Should you select to cease paying your premiums earlier than the coverage expires, your protection merely ceases at that cut-off date and also you now not get pleasure from insurance coverage protection. In contrast to complete life plans, there isn’t a give up worth to be paid out.

How A lot Protection Ought to You Have?

If funds is just not a priority, all of us would need to purchase as a lot protection as we presumably can. This after all isn’t real looking, since all of us stay in the true world the place any insurance coverage protection that we purchase will prices us.

There are two key elements that it’s best to contemplate when figuring out the protection quantity that you just want. If want be, you must also work with a trusted insurance coverage adviser to higher perceive the protection quantity that you just want and are capable of afford.

Loans that you’ve got: Ideally, any loans that you just tackle must also be insured for. That is to make sure that your insurance coverage payout will probably be ample on your family members to have the ability to settle any excellent loans that they don’t seem to be liable to pay for in your absence. Examples of such loans will embrace your housing loans, automotive loans and renovation loans.

How a lot your family members will want for day by day residing: Take into account your youngsters, your dad and mom (in case you are supporting them) and your partner (if he/she isn’t working), how a lot monetary assist will they want in case you are now not offering for them? To your youngsters, you might want to present them with ample revenue until they’re grownup and capable of work and supply for themselves. Within the case of your dad and mom, it’s best to estimate how a lot revenue they want every month to assist themselves. A lumpsum quantity from the insurance coverage payout can then be used to high up their CPF Retirement Account, making certain that they won’t outlive their financial savings.

Whereas it may be tempting to purchase extra protection than you really want, it’s vital to do not forget that the premium you pay for time period protection is non-recoverable. So, there isn’t a lot worth to over-insuring your self.

Causes Why You Could Select A Time period Life Insurance coverage Plan

By now, you’d know that time period life insurance policy are purely for cover functions over an outlined time period.

For instance, you probably have excellent loans (e.g. housing mortgage), these loans ought to already be paid off by a sure interval in time. Your children and fogeys, who’re reliant in your monetary assist at the moment, are usually not going to (hopefully) want your assist for the remainder of your life.

That is why time period life insurance policy cowl you just for a time period. Throughout this era, you’ll pay the insurance coverage premiums and obtain the protection that you really want, till the coverage lapses or when you select to cancel it prematurely – which can also be attainable when you now not really feel you want the protection that it offers you for.

When Ought to You Purchase A Time period Life Insurance coverage Plan?

Key milestones in life – corresponding to getting your first job, shopping for an HDB flat, having youngsters, taking over a enterprise mortgage – are widespread events when it’s best to overview your insurance coverage protection wants and presumably, enhance your time period life insurance coverage protection quantity if it’s required.

In fact, you may additionally need to contemplate getting a complete life insurance coverage plan as an alternative. Finally nonetheless, you might want to contemplate your funds and your causes for wanting to purchase a life insurance coverage plan and be sure that the insurance policies that you just purchase match each your funds and desires. You may learn up extra concerning the variations between time period and complete life insurance policy right here.

How To Perceive A Time period Life Insurance coverage Plan?

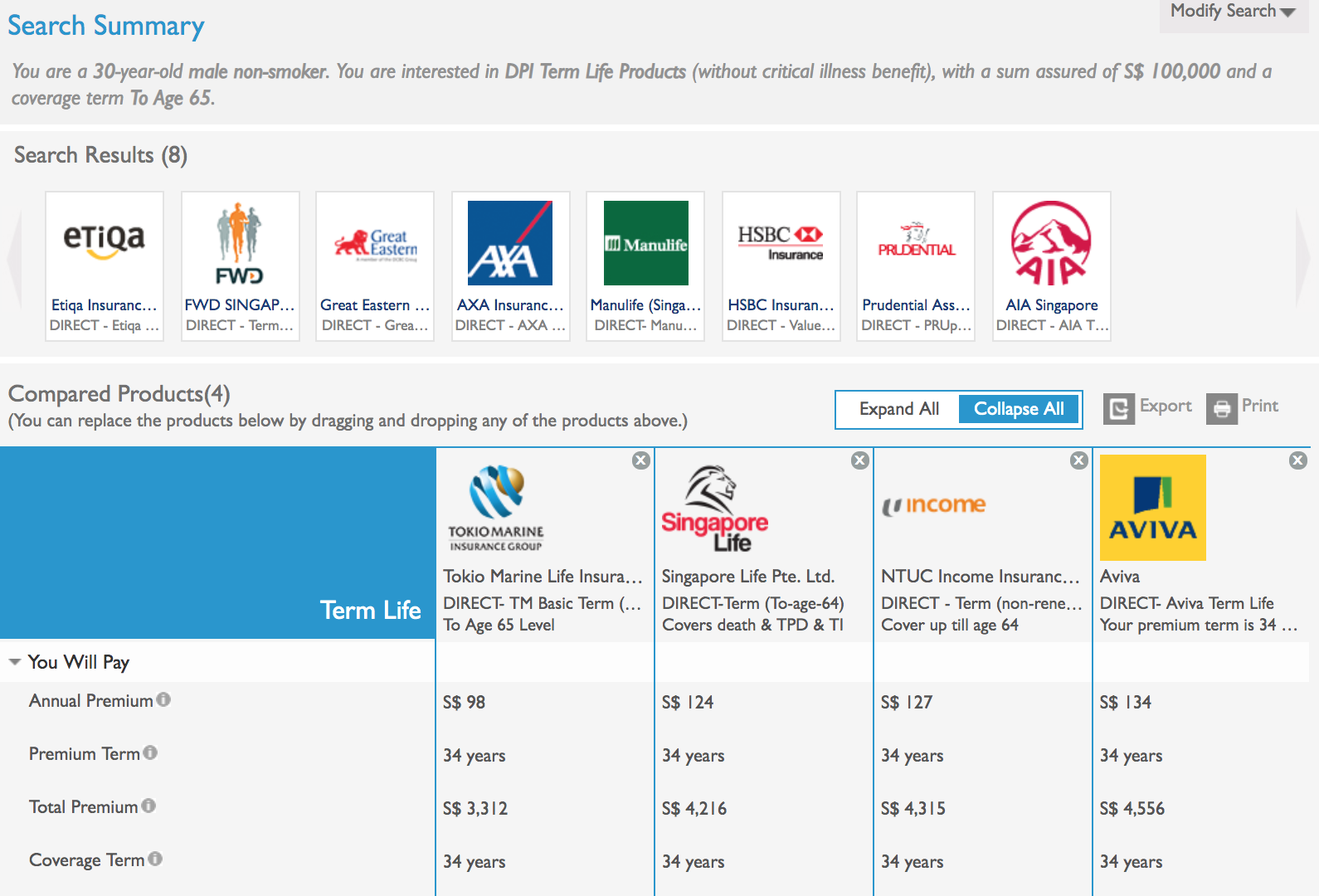

Primarily based on a fast search that we did on compareFirst, we discovered that for a 30-year-old male non-smoker searching for sum assured of $100,000 until age 65, we are able to count on to pay round $100 to $150 a 12 months in premium.

Supply: compareFIRST

Supply: compareFIRST

Past simply the premium, there may be some extra particulars that might differentiate the time period life insurance policy supplied by every insurer. So, it’s value trying out the product brochure for these plans and/or to talk to a trusted monetary adviser to search out out extra.