With one of many highest life expectancy at delivery of 84.8 years, it ought to come as no shock that the variety of centenarians in Singapore has additionally elevated considerably over the previous 10 years, from 700 in June 2010 to 1,500 in June 2020.

Because of developments in medical know-how and more healthy residing, individuals in Singapore can count on to dwell even longer lives sooner or later. This brings us to an necessary query: if we’re going to dwell longer lives in comparison with the era earlier than us, what can we do with the extra years? Will we use the additional years to volunteer for a trigger that we imagine in, pursue an curiosity that we now have, or lengthen the variety of years that we might proceed working for?

And with our extra years on the planet, we should be ready to construct for ourselves a multi-stage life that goes past simply the standard three levels – faculty, work and retirement.

This may occasionally embrace additional training and retraining as we discover methods to remain related in our workforce. Choices to take a sabbatical earlier than pursuing our subsequent profession may additionally remodel the standard three levels of life that we’re used to into an extended, multi-stage life that will appear to be faculty, work, sabbatical, faculty, work, retirement.

In concept, this sounds possible and even logical. In actuality, a 2018 analysis paper commissioned by Prudential confirmed that greater than half of Singaporeans surveyed weren’t able to dwell until 100. So what can we do to organize ourselves financially for a multi-stage life that would stretch past 100 years?

#1 Save & Make investments A Bigger Portion Of Our Earnings

As we embrace a multi-stage life that will embrace a number of intervals of non-work, we have to take proactive steps to make sure that we now have sufficient not only for our retirement, but additionally when we aren’t working reminiscent of throughout our sabbatical or when pursuing additional training. This implies diligently saving a bigger proportion of our earnings throughout our working years.

In addition to saving, we additionally want to speculate our financial savings. This can enable us to develop our retirement nest egg and to make sure that inflation doesn’t erode the spending energy of our financial savings.

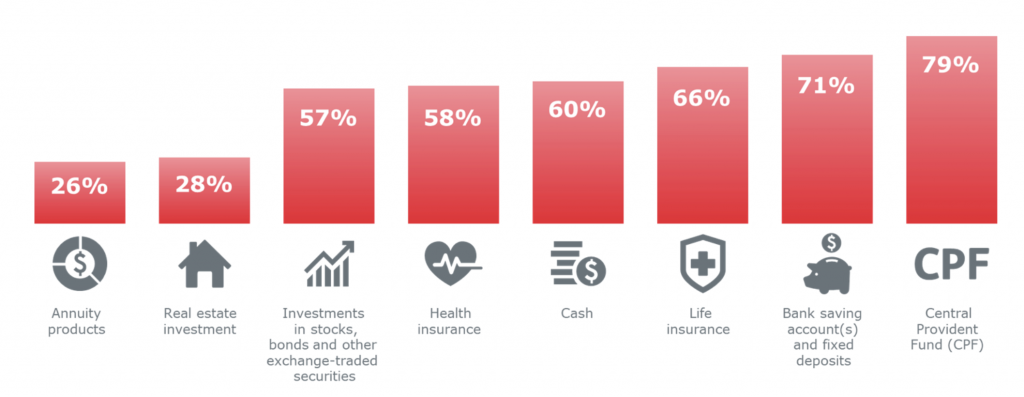

In line with Prudential’s Saving For 100 analysis, the highest three hottest instruments that Singaporeans are utilizing are their CPF (79%) , financial institution financial savings accounts and glued deposits (71%) and 66% (life insurance coverage). Which brings us to our subsequent level.

Supply: Saving for 100: Saving for longevity in Singapore report by Prudential Singapore

#2 Utilising CPF LIFE & Retirement Insurance coverage Plans To Receive Increased Month-to-month Payouts

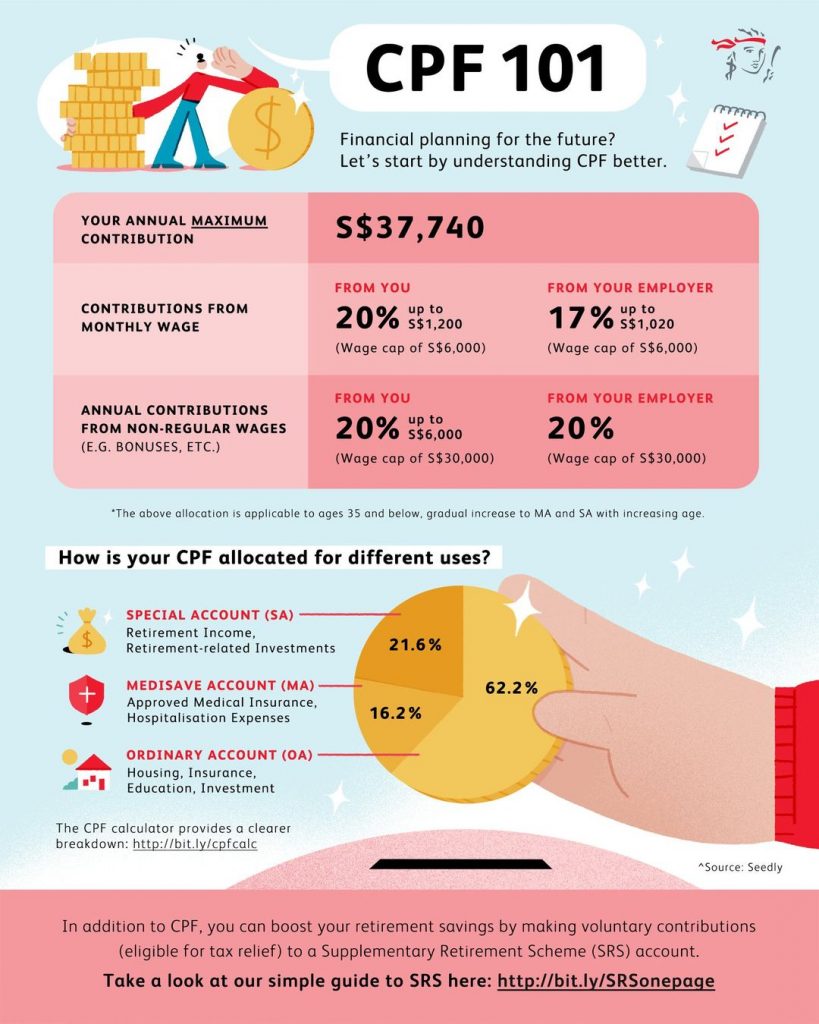

As Singaporeans and PRs, we now have to make necessary contributions to our CPF accounts every month once we work.

Supply: Prudential Fb Web page

Maybe as an indication that even the Singapore authorities understands that individuals have to plan to dwell past 100, CPF LIFE was launched in 2009 to interchange the Retirement Sum Scheme (RSS). The crucial distinction between CPF LIFE and the RSS is that CPF LIFE offers a lifelong month-to-month payout for so long as we dwell whereas the RSS offers month-to-month payouts that’s anticipated to final until 95.

For individuals who want to have a better lifelong assured earnings, we will contemplate topping up our CPF Retirement Account to the Enhanced Retirement Sum, which is $271,500 as of 2020. This can give us a month-to-month lifelong payout of between $2,030 – $2,180 from 65.

Learn Additionally: CPF LIFE VS Retirement Sum Scheme: What’s The Distinction?

Nevertheless, relying on the usual of residing that you’re used to, CPF LIFE will not be sufficient to give you all of the earnings that you just want. In line with the newest Family Expenditure Survey 2017/18, the month-to-month bills for a non-working particular person aged 65 and above who resides in a condominium or non-public condominium is $2,680 monthly. On this occasion, the person would want to have extra earnings to complement his month-to-month CPF LIFE payouts.

A retirement insurance coverage plan is one software that we will use to supply us with supplementary earnings for our retirement. As in comparison with CPF LIFE, retirement insurance policy are extra versatile and might cater to the precise wants of people.

For instance, those that want to go for early retirement can use a retirement insurance coverage plan such because the PRUGolden Retirement Premier, which permits us to start out payouts from as early as 55. We will select how lengthy we would like the payout interval to be. So, if we wish to retire at 55 however want a gentle stream of earnings to maintain us until our CPF LIFE payouts begin at 65, we will select a payout interval of 10 years, ranging from 55.

For these of us who want larger flexibility, we will contemplate the PRUActive Retirement plan. This plan permits us to customize when our payout interval begin, from age 50 as much as age 110. So whether or not you wish to have an early retirement or intend to work until your later years, the PRUActive Retirement is appropriate in supporting the selections you wish to make on your multi-stage life.

Learn Additionally: How A lot Extra CPF LIFE Month-to-month Payouts Would You Obtain If You Deferred Until 70

#3 The Remaining Lease On The Residence That We Purchase

Some Singaporean residence patrons are interested in older HDB flats and rightly so. Older flats are usually 1) situated in central areas reminiscent of Kallang and Ang Mo Kio 2) are normally extra spacious and three) could also be cheaper in comparison with newer flats in the identical space.

Nevertheless, when shopping for a resale flat, one issue to be conscious of is the remaining lease on the flat. For instance, shopping for a 40-year outdated flat means having a remaining lease of simply 59 years from once we buy it. For a 30-year-old purchaser, because of this the lease will run out when the particular person is 89.

Now that many people should be prudent about planning to dwell past 90 and even 100, we must always rigorously contemplate the remaining lease on the house we buy as we might ideally not wish to outlive the lease on our residence.

#4 Think about Insurance coverage Insurance policies That Present You With Protection For Life

There are two primary sorts of insurance policy – Complete Life Insurance coverage Plans and Time period Life Insurance coverage Plans.

As their names counsel, a complete life insurance coverage plan offers us with insurance coverage protection for all times, or up until age 100. A time period life insurance coverage plan normally offers us with insurance coverage protection for a particular time period, normally up until age 70 or 75. Nevertheless, some time period life insurance policy reminiscent of PRUActive Time period could will let you purchase protection until age 100.

As we dwell longer, we could want to have insurance coverage protection to cowl us throughout our later years, and even all through our total life. For instance, we could want to have a complete life crucial sickness plan that gives us with a lump sum payout if we’re recognized with any crucial sicknesses throughout our lifetime. That is when a complete life insurance coverage plan shall be necessary.

#5 Embrace Studying In Our Multi-Stage Life

With regards to studying, the standard mindset that we used to have was that individuals study at school earlier than becoming a member of the workforce to work. In 2020, such a perspective is now not relevant. Somewhat, to maintain ourselves related in our later years, we must always frequently upskill ourselves.

SkillsFuture is the umbrella motion to assist Singaporeans of their journey of lifelong studying {and professional} improvement. Amongst different issues, the SkillsFuture framework offers an built-in eco-system of high-quality, related, and industry-recognised instructional and coaching programmes, no matter your age or stage of profession. Subsidies are additionally supplied through quite a lot of credit, grants, and even scholarships obtainable.

Learn Additionally: Up To $1,000 In Credit From 1 October 2020: Understanding The Subsequent Certain Of SkillsFuture And How You Can Spend It

Past simply utilising their SkillsFuture credit, many working professionals are additionally embracing lifelong studying.

An instance is Darren Ho. One of many founders of native males’s title AUGUSTMAN. Darren took a while off in 2017 to reassess his life and after spending a couple of months choosing up new data in e-commerce whereas travelling by means of Western Europe and Asia, Darren returned to Singapore to work for a worldwide content material and e-commerce platform. Because of the COVID-19 pandemic, Darren has switched to a brand new {industry} – promoting whereas concurrently pursuing additional research. You may learn up extra about Darren’s expertise right here.

As extra of us start on our multi-stage lives, we could discover that just like Darren, our careers and even our youngsters’s careers won’t conform to conventional societal norms that we have been introduced considering. Profession switches, additional research, fixed upskilling and even taking a sabbatical through the peak of our careers could grow to be growing frequent sooner or later. We can also discover ourselves working past the retirement age – not as a result of we now have to, however as a result of we wish to and are in a position to.

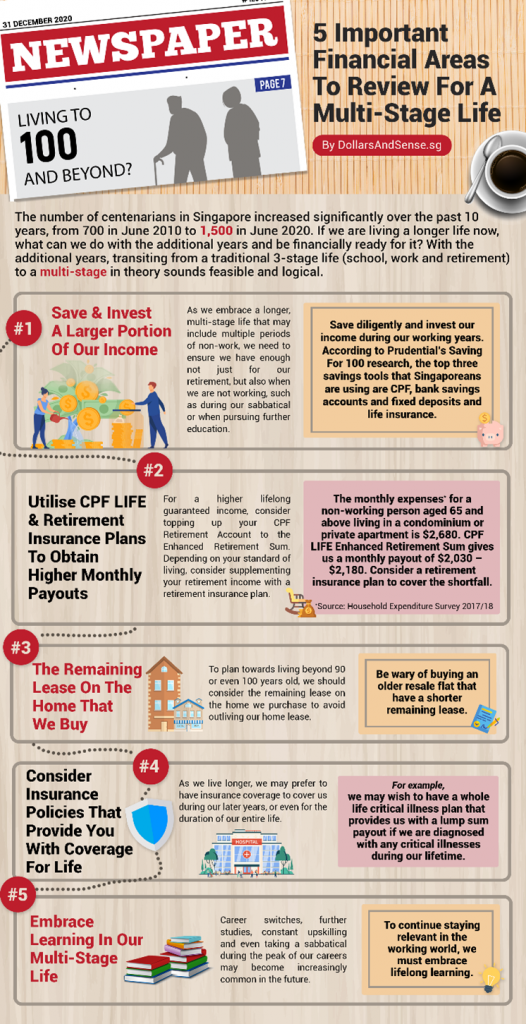

We captured all these concerns in an infographic:

With all these in thoughts, it’s smart to contemplate having a holistic long-term plan to assist us put together for this longer, multi-stage life. With the extra life span, residing a satisfying lengthy life is feasible once we are financially ready and set sensible targets to grasp our desires that we now have at all times need.

Do you might have a “sport” plan in thoughts now to organize you to dwell to 100 or past? In the event you want steering on what to do financially, get in contact with a Prudential Monetary Advisor who can provide you recommendation on the steps to organize your self to dwell past 100.

Disclaimer:

You might be advisable to learn the product abstract and search recommendation from a professional Prudential Monetary Advisor for a monetary evaluation earlier than buying a coverage appropriate to fulfill your wants.

As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage normally includes excessive prices and the give up worth, if any, that’s payable to you could be zero or lower than the whole premiums paid.

Premiums for some supplementary advantages should not assured and could also be adjusted based mostly on future claims expertise.

The data on this web site is for reference solely and isn’t a contract of insurance coverage. Please check with the precise phrases and circumstances, particular particulars and exclusions relevant to those insurance coverage merchandise within the coverage paperwork that may be obtained out of your Prudential Monetary Advisor.