To get a mortgage of any sort, it’s a must to be permitted by the lender. And meaning assembly the eligibility necessities. However what are the eligibility necessities for a private mortgage? Turns on the market’s not a simple, one-size-fits-all method to that reply.

Discover out extra about frequent kinds of necessities for loans under, after which see how you might qualify a private mortgage with out assembly lots of them.

5 Frequent Necessities for Private Mortgage Approval

We’ve gathered a few of the extra frequent necessities for private loans under and defined them additional. But it surely’s essential to notice that some lenders could not contemplate a few of these components. Don’t suppose you possibly can’t get a private mortgage when you aren’t capable of meet all 5 of those necessities.

1. A Credit score Rating That Meets Minimal Necessities

Many mortgage corporations gained’t approve individuals who don’t have a credit score rating above a specific amount. Sometimes, a “good” credit score rating — someplace above 660, relying on the credit score bureau — offers you the most effective possibilities of being permitted for credit score. Nevertheless, many lenders that provide private loans are keen to offer credit score to individuals with credit score scores under 660 or 670, which is taken into account to be the cutoff for “good” credit score.

That doesn’t imply there isn’t a reduce off, and if in case you have a really low credit score rating, you might discover it arduous to get permitted for a private mortgage. Do your analysis on mortgage necessities earlier than making use of. You don’t wish to waste your time if you already know a lender requires a sure rating and also you don’t have it.

2. Proof That You Can Make the Mortgage Funds

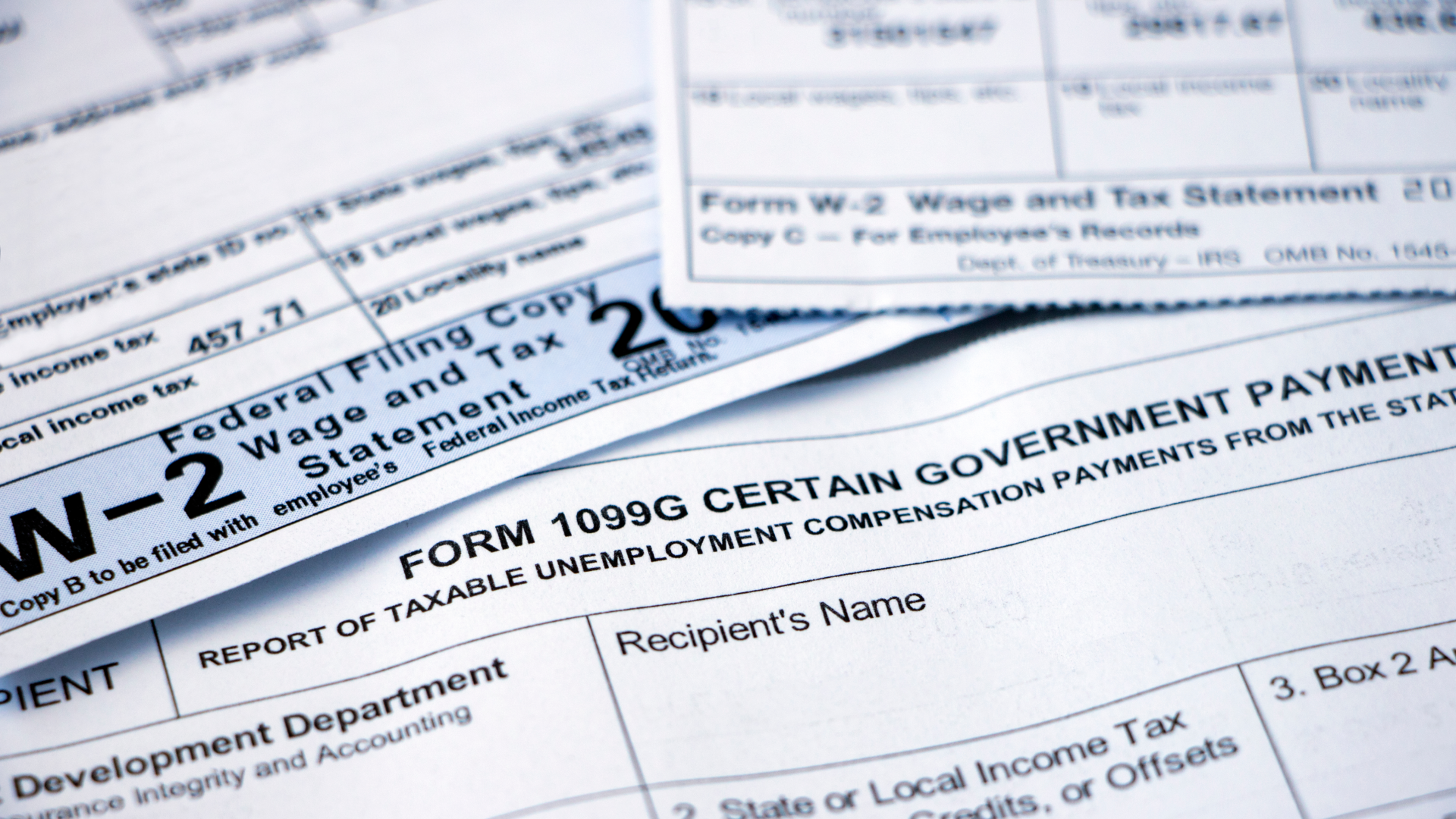

Many lenders wish to see proof in your means to make funds on the mortgage they’re supplying you with. Sometimes, that comes within the type of proof of revenue. It’s possible you’ll want to offer copies of W-2s, paycheck stubs or tax paperwork to display how a lot you make every month.

In case you don’t have a standard revenue, you might want to offer paperwork exhibiting the place the cash goes to come back from to pay the debt. That might embrace paperwork demonstrating your self-employment revenue, funding revenue or perhaps a financial savings account with sufficient cash to allow you to make funds.

3. A Debt-to-Earnings Ratio under a Sure Quantity

In some circumstances, it’s not sufficient to doc that you’ve got a sure revenue. Lenders could wish to know that you’ve got sufficient room in your month-to-month funds to realistically pay the debt. In these circumstances, they’ll be taking a look at what’s referred to as the debt-to-income, or DTI, ratio.

DTI is the ratio of your complete debt funds every month to your revenue. The Shopper Monetary Safety Bureau notes that 43% is a well-liked DTI determine, particularly for house loans. In reality, many mortgage lenders gained’t approve individuals for mortgages that deliver them above that proportion.

To know how DTI is calculated, contemplate the instance under:

- Somebody makes $3,000 a month.

- They’ve the next money owed:

- $500 automotive fee

- $100 private mortgage fee

- $150 in minimal bank card funds

- These money owed complete $750 per thirty days.

- The DTI is $750/$3,000, or 25%.

Lenders of every kind could have their very own DTI necessities. In case you’re denied a private mortgage as a result of your DTI is just too excessive, you possibly can take some steps to decrease it by both paying down debt or elevating your revenue.

4. A Lack of Sure Varieties of Objects on Your Credit score Report

Some lenders gained’t approve loans for individuals who have sure kinds of detrimental gadgets reported on their credit score information. That’s very true if the gadgets are comparatively latest.

Once more, this comes right down to the insurance policies of the lender, however some detrimental gadgets that may make it tougher to get permitted for a private mortgage embrace:

- Extraordinarily late funds or a behavior of late funds. Virtually no lender will balk at one 30-day late fee on a credit score report. We’re all human, and even lenders know errors and emergencies occur. But when your credit score report is dotted with late funds or you’ve gotten funds 90 or 120 days late, lenders could take extra discover.

- Collections accounts, particularly in the event that they’re unpaid. In case you’ve beforehand let a debt get to collections and you continue to haven’t resolved the matter, then that creates doubt for a lender that you just’re somebody who will honor your settlement with them.

- Foreclosures or repossessions. The identical is true for permitting a mortgage to get so late that your property is repossessed. It sends a message to lenders that you could be not have the option or keen to pay your money owed.

- Relying on the kind of chapter you’re submitting, you might not have the ability to get credit score with out the courtroom’s approval instantly. Lenders may additionally be hesitant to approve a private mortgage for somebody who has not too long ago declared insolvency, which quantities to formally stating you can’t pay your money owed.

None of those are essentially a tough cease in the case of getting a private mortgage, although, particularly in the event that they occurred years in the past quite than months in the past.

5. Collateral Useful Sufficient to Safe the Mortgage

In case you’re making use of for a safe private mortgage, you want one thing you should utilize as collateral. This can be a piece of property or merchandise of worth that may safe the mortgage. In this sort of mortgage settlement, when you fail to make funds as agreed, the lender can take the merchandise you place up for collateral and promote it to recoup a few of its losses.

In some circumstances, the lender holds on to the collateral. One frequent instance of this can be a pawn store mortgage. If you pawn one thing, the pawn store offers you cash for it. It then holds the merchandise for an agreed-upon period of time. In case you pay again the mortgage, you get your merchandise again. In case you don’t, the pawn store is free to promote it.

Extra generally, you maintain onto the safety. The lender solely repossesses it when you default on the mortgage. An instance of this could be a private mortgage secured by the title on a ship or leisure automobile.

Getting a Private Mortgage Even when You Can’t Meet These Necessities

If these necessities sound daunting since you haven’t had time to construct credit score otherwise you’ve had some monetary mishaps, don’t fear. There are mortgage merchandise you possibly can qualify for with out assembly all or a few of these eligibility necessities.

Sensible Mortgage loans, for instance, don’t require a terrific credit score rating or sturdy credit score historical past. In reality, with some primary details about your revenue, a checking account and an ID, you might be able to get permitted for a private mortgage with Sensible Mortgage.

Discover out extra about how Sensible Mortgage loans work and apply immediately.

The suggestions contained on this article are designed for informational functions solely. Important Lending DBA Sensible Mortgage doesn’t assure the accuracy of the data offered on this article; just isn’t chargeable for any errors, omissions, or misrepresentations; and isn’t chargeable for the implications of any choices or actions taken because of the data offered above.