Shopping for a trip residence to make use of one weekend a month with the household feels like an incredible factor on the floor, however is it actually what your loved ones desires? Or is it what you need? In case you are contemplating forking out the cash for a trip residence with the excuse that your children at the moment are younger and also you wish to make some nice recollections on the cabin on the lake earlier than they develop into teenagers, you would possibly rethink.

Should you purchase a trip home for your loved ones, however find yourself working late every single day arriving residence after the youngsters have gone to mattress with the intention to earn the cash to pay for it, who’re you kidding?

Generally I ponder if physicians assume the one trip that counts is the one which prices some huge cash. Contemplate the next statements:

*We all the time keep at luxurious lodging as a result of my partner has ‘X’ illness and there aren’t any ensures in life.

*I purchased an costly jet boat to fish with my son on the river so we don’t want a second driver to choose us up after drifting down the river in a reasonable drift boat. I simply don’t have the time to shuttle automobiles.

*We purchased a lake cottage 1.5 hours away to make use of in the summertime to make nice household recollections whereas the youngsters are little.

*We took our 2 yr outdated to LEGOLAND for some nice recollections.

*Carpe diem. You solely stay as soon as.

*What good is cash for those who don’t use it to spend time with your loved ones?

*We would like a seaside home, a lake home, a mountain cabin and an RV.

*I purchased my teen that model new automobile as a result of she wanted one thing that was dependable.

*I’d fairly get pleasure from life now and work a little bit longer than miss my child’s early years and retire a little bit sooner. (Used to justify a lake trip residence buy)

*We purchased the costly residence within the suburbs as a result of nothing on the town had the acreage we’d like.

*My revenue will develop so the home will develop into extra reasonably priced with time.

*Recollections are extra beneficial than index funds.

*Life is brief so get pleasure from your loved ones whilst you can.

*My son actually loved the clown, the bounce home, the ponies and the magician at his third birthday celebration. What nice recollections we made.

*We picked up a discount seaside home 2,500 miles from residence to make use of for excellent household holidays every summer season.

Simply so you already know that I’m not immune from this YOLO (you solely stay as soon as) pondering, a type of statements was made by me when my children have been younger.

What do this stuff have in frequent? They recommend the necessity to spend cash to make recollections, as if the 2 yr outdated can truly recognize LEGOLAND, or the three yr outdated wants an costly birthday celebration. The additionally recommend the notion that recollections are made on the expense of retirement financial savings. None of those assumptions are true.

Suppose again to when your children have been very small. Typically on Christmas morning, that they had simply as a lot enjoyable taking part in with the field their toy got here in as they did taking part in with the toy. Spending cash will not be what it takes to make nice recollections along with your youngsters.

It’s not what you try this makes a distinction; it’s that you’re doing it collectively that counts. What you do collectively doesn’t must price cash. Going to your lake cabin to have enjoyable is absolutely no completely different than doing enjoyable issues at residence. The time you spend one weekend a month attempting to make up for being absent the remainder of the month will not be a great commerce.

Making enjoyable recollections at residence every day is a much better various. Work rather less, make rather less, and spend much more time at residence with your loved ones. You’ll be able to all play playing cards collectively at residence in addition to you’ll be able to at a trip residence. That will help you discover enjoyable issues to do round your house learn my article having a profitable staycation.

Consider methods you’ll be able to spend extra time with your loved ones. Have dinner collectively each night time, coach your daughter’s soccer workforce, make it to all of your child’s sporting occasions, attend the performs they’re in at college, or go fishing close by.

A radio character was interviewed about his life. He made $300,000 a yr doing the morning drive time present in a serious metropolitan space. Then he hopped on a aircraft to do the afternoon drive time present in one other giant metropolitan space for one more $300,000 a yr. He arrived residence each night time after his children have been in mattress. His weekends have been spent making commercials for one more $100,000 a yr.

The interviewer identified that he had a really busy schedule and requested why he stored such a busy schedule. He stated he was “doing it for his household.” It’s arduous to consider that anybody would assume that being away from their household a lot was benefiting their household. The one profit he was supplying was monetary stability. It sounds to me like he doesn’t wish to spend time together with his household so he works on a regular basis and pretends it’s for the household.

If he was doing what was greatest for his household, he would have simply achieved the morning present in his residence city for $300,000 and spent the remainder of the day together with his household residing an incredible life.

The reply to creating recollections along with your children whereas they’re younger is to not spend more cash, however to spend much less! Debt retains you working extra and subsequently you spend much less time with your loved ones. Paying the mortgage on the brand new trip residence means it is advisable to work extra and see your loved ones much less. In case you are making $4,000 a month in debt funds, you will want to earn $6,000 a month to finish up with the after tax revenue to service the debt. Should you paid off the debt, or by no means acquired it within the first place, and didn’t must earn an additional $6,000 a month, you would come residence early every single day and spend your further time with your loved ones.

In case your job brings in $24,000 a month, meaning with out the debt you would work ¾ time and have the identical cash out there to spend. How would your life be for those who took an additional time without work each week? What about coming residence a couple of hours earlier every single day? How would your loved ones like that?

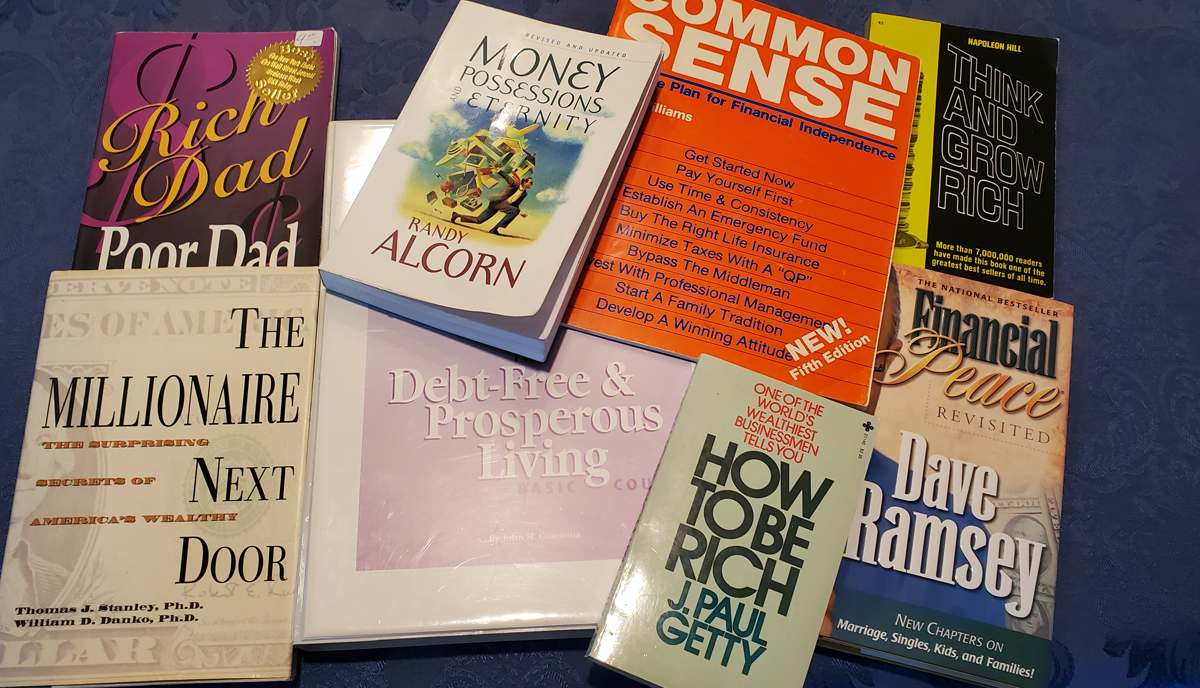

Cease attempting to impress your loved ones by spending cash and begin impressing them by spending time. Bear in mind what’s vital, not what appears to be like good to pals and coworkers. The image with this text is my son’s youth soccer workforce I coached. We had an hour observe twice every week and an hour recreation on Saturdays. I did that as a full-time basic surgeon. I discovered methods to spend time with my children by doing issues with them that they loved. You can also spend extra time with your loved ones by making them a precedence. That is greatest achieved by being content material along with your revenue and never borrowing/spending cash that forces you to work further hours.

Should you want to achieve a brand new potential on how debt is hurting you and your loved ones, learn my ebook, The Medical doctors Information to Eliminating Debt. Isn’t it time you cease managing your debt and begin eliminating it so you’ll be able to have extra household time? They need you, not your cash.

Share this text: