Most individuals with Debtabetic Neuropathy don’t know they’ve it. This sneaky illness creeps in with out being observed. In case you have ever rationalized borrowing cash to purchase a automobile as a result of the rate of interest was low or satisfied your self one thing was a “Good Debt” then it is advisable to perceive Debtabetic Neuropathy, since you might need a foul case of it. Let’s look at the way you get it and why it’s so unhealthy?

Assume again to a couple months earlier than your highschool commencement. Standing within the kitchen with Mother and Dad, studying your first monetary assist/pupil mortgage bundle from Dream School College. Is your hand shaking from the chance or in worry of the looming debt? You start to surprise:

How will I ever pay it off?

How a lot will the curiosity whole?

Can I afford this?

It’s a little bit scary, taking over debt for the primary time. Possibly even horrifying.

You conquered the worry and took the plunge, becoming a member of the ranks of different People in debt. When the sophomore monetary assist bundle arrived, it was a little bit simpler to tack on a brand new mortgage. In spite of everything, nothing unhealthy occurred with the final one. Some large dude with a bat didn’t present as much as break your legs for not making any funds. The financial institution wasn’t sending any nasty letters. Everybody was saying it might be simple to pay it off after commencement, when the large bucks could be rolling in.

So you probably did it once more, including the subsequent pupil mortgage to the debt pile, and nonetheless nothing unhealthy occurred. Every year it received simpler and simpler so as to add extra debt. You progressively grew to become desensitized to the debt. One thing horrible, initially, had turn out to be acceptable.

Quick-forward to the ultimate 12 months in medical faculty. Eight years of including it to my debt and I’ll pay it later have handed. It was really easy so as to add extra debt the eighth 12 months. What’s going to it matter in the event you borrow a little bit bit extra?

In case you take a second to mirror in your borrowing years, you notice the way it occurred so progressively. You grew to become so numb to the concept of debt because it meant nothing to you anymore. For eight years, you added to it and nothing occurred. Life went on, and also you stored borrowing for belongings you needed, at all times considering it might be simple to pay later. This laissez-faire angle units you as much as make some unhealthy selections.

When the true property agent talks you into taking a look at a way more costly home than you have been contemplating, taking over the additional debt is not any large deal. Debt is nothing, simply toss it on the pile. When the automobile salesperson exhibits you the right alternative for a health care provider, he can simply persuade you to drive away in your dream automobile with these “small” month-to-month funds. Debt is nothing, simply toss it on the pile. Once you drive by the RV lot and see the proper motorhome, you’re certain you possibly can deal with the funds. You’ve not had any bother—but. Debt is nothing, simply toss it on the pile.

Gross sales representatives see a health care provider as an enormous fish, a whale, or a simple mark—and so they consider you may have poor funding information, excessive earnings, and excessive debt tolerance. That’s why you get so many chilly calls from buyers, salespeople, and brokers. They consider you make some huge cash and will not be afraid to borrow much more.

Solely after you start to face the implications of piling on all this debt, do you notice what a monster you may have created. Once you attain the purpose the place the straightforward month-to-month funds will not be really easy anymore, you start to consider debt in a brand new gentle—however now it’s too late. You already owe the cash. You made the deal. You signed the papers. You’re hooked like a Chinook salmon on the finish of a fishing line.

In 1950, the present idea of the bank card was born. It grew to become doable to successfully have retailer credit score in a number of shops, all on one invoice. This idea expanded over time, and now nearly every little thing could be purchased on credit score. Most individuals at this time consider it isn’t doable to purchase a automobile with out having a automobile cost. Society has grown accustomed to credit score. If we have been to cease utilizing it, many industries would fold, as a result of their gross sales are fully depending on credit score. If individuals needed to save up the cash first, most would by no means be capable to purchase a brand new automobile at at this time’s costs.

With a society dwelling on credit score, a authorities deep in debt, a few years of desensitization throughout coaching, rising tuition, and falling pay—it’s no surprise properly educated professionals are having a significant drawback with debt. The place will it finish? Debt has turn out to be the norm. Will Rogers summed up this sample of excessive consumption on borrowed cash properly.

“Too many individuals spend cash they haven’t earned,

on issues they don’t need,

to impress individuals they don’t like.”

Most docs have seen a long-term diabetic affected person someday throughout their profession. After a few years of out-of-control blood sugar, nerve injury begins to happen. The affected person begins to lose feeling in his or her ft.

Tim was one such affected person with diabetic neuropathy, who purchased a brand new pair of sneakers for a trip. He got here dwelling from trip and famous a fever and a foul odor coming from his foot. These new sneakers had precipitated a blister on his foot, however he couldn’t really feel it because of the neuropathy. As he continued to stroll on the blister, the injury received worse. Later, the blister popped and the wound grew to become contaminated. Your entire backside of his foot was misplaced.

Informing Tim of the necessity for a below-knee amputation was not simple. He would have none of it. Nobody was going to chop off his foot. He had been a diabetic for a few years and took glorious care of his ft, regardless of the neuropathy, and he wasn’t going to lose one now. He couldn’t really feel the issue and he couldn’t see the issue, however the issue was there nonetheless. The highest of his foot, which was all he might see, appeared a little bit crimson. I received a mirror so Tim might see the underside of his foot. Solely after personally seeing all of the pores and skin and subcutaneous tissue lacking, and the tendons and bones seen, did he lastly notice there was an issue—a major problem.

This example is just like what debt is doing to docs in medical faculty. We don’t see the issue, we don’t really feel the issue, and so what’s the large deal? Everybody else is doing it. Medical doctors are affected by Debtabetic Neuropathy:

Debt is like poorly becoming sneakers on numb ft.

Your monetary future is rotting away

and also you’re not even conscious it’s occurring.

Ultimately the odor will get your consideration, however by then it’s too late. A chapter (amputation), divorce, or perhaps a suicide could also be looming on the horizon.

Don’t let Debtabetic Neuropathy

get a foothold on you.

Have you ever ever borrowed cash to purchase a automobile and justified it as a result of the rate of interest was low? Then you may have Debtabetic neuropathy.

Have you ever ever considered paying off your own home early however didn’t do it as a result of it was “Good Debt”? Then you may have Debtabetic Neuropathy.

Have you ever ever rationalized debt by taking part in the “rate of interest arbitrage” recreation with unrelated objects reminiscent of borrowing cash to purchase a automobile at a low rate of interest so you might put money into the inventory market to earn a better rate of interest? Then you may have Debtabetic Neuropathy.

Don’t despair as there’s hope. You may conquer the problem of being perpetually in debt. The cycle can finish at this time. Now’s at all times an excellent time to cease managing debt and begin eliminating it.

My spouse and I grew to become personally debt free over 20 years in the past and have stayed that approach. No extra borrowing to purchase stuff in our private lives. At the moment the one debt we now have is a small rental actual property mortgage that our tenants are paying off for us, which produces a terrific passive retirement earnings.

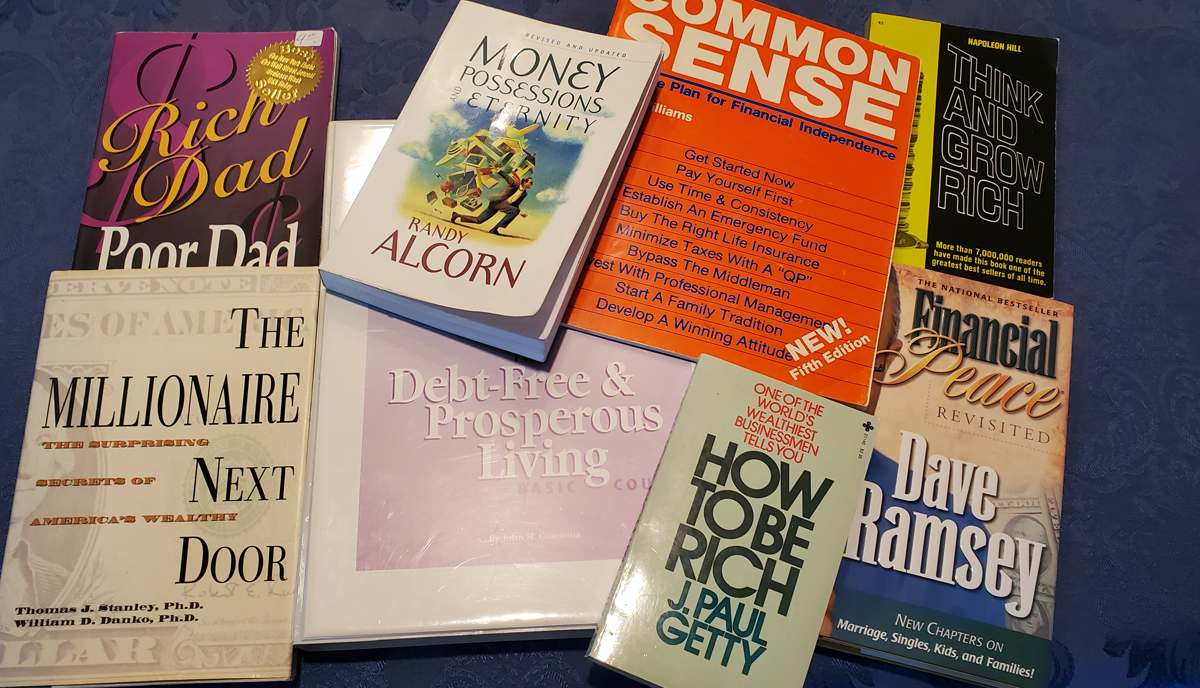

In case you want extra motivation to beat Debtabetic Neuropathy, then decide up a duplicate of The Medical doctors Information to Eliminating Debt and begin down the trail to turning into debt free. My spouse and I eradicated over $500,000 of debt once we made the choice to personally turn out to be debt free.

Life is quite a bit higher with out debt. Don’t child your self into considering you might be doing your self a favor by utilizing debt to get one thing a little bit sooner. Debt is just not your buddy and may delay your retirement by a number of years. I retired early as a result of I selected to eradicate private debt from my life. You may too.

Share this text: