Instructing children about cash is essential. Those that find out how cash needs to be used early in life, will rework their future. A baby who graduates from highschool pondering that dwelling on lower than they make, saving/investing cash for the longer term, and avoiding private debt are good issues, may have a really affluent future.

The school graduate who begins their retirement financial savings after they begin their first job has a leg up on those that start their grownup life spending all they earn. So, train your children the next rules and get them off to an incredible begin.

A very powerful approach to educate your children about cash is to mannequin what it seems to be prefer to deal with cash properly. A good time to speak about it’s over the dinner desk. Discuss to them about why you’re saving to purchase a automotive as an alternative of leaping at these simple month-to-month funds. Inform them about your financial savings plan and why it is necessary. Don’t let cash be a taboo topic. Ensure that your children know why you deal with your cash within the manor you do. Inform them about cash errors you’ve got made to allow them to study out of your expertise somewhat than need to determine it out by trial and error. Having a automotive repossessed is a tricky approach to study a lesson they might have discovered one other means. Additionally train them to be beneficiant with their giving.

There’s a recreation I extremely advocate you play along with your children to show them the rules of private finance. Whereas they’re having enjoyable taking part in the sport, they don’t even notice they’re studying helpful life classes about how cash can change their lives. Seems like an incredible Christmas current to me.

The sport is Cashflow (Investing 101). It initially got here out in 1996 and was revised in 2014. I personal the unique recreation for youths age 10 and up. There may be additionally a child’s model of Cashflow for ages 6-10. (I would not have any monetary relationship with the maker of the sport.)

This recreation is considerably like monopoly, however all of the transactions are issues that occur in the actual world. As an alternative of taking part in as a board piece, every participant is an individual with an actual occupation corresponding to physician, instructor, engineer, janitor, or airline pilot. You even have the choice of taking part in as your self.

Together with a job title comes the precise earnings and bills of that occupation. Whenever you examine the physician’s monetary state of affairs with the instructor’s funds, you may suppose you need to be the physician, like I did at first, as a result of they make a lot more cash on each payday in comparison with the instructor. However I haven’t been capable of win the sport because the physician and I nearly at all times received because the instructor. If taking part in as your self, you’ll be able to put in your personal monetary state of affairs and play the sport beginning along with your precise earnings and bills.

Every occupation comes with an actual life set of economic circumstances. The physician, together with the upper earnings, has extra debt, an even bigger home, a dearer automotive and the fee for every extra little one accrued through the recreation is way greater. In spite of everything, the physician sends her children to personal faculties, takes personal music classes, and buys the youngsters airplane tickets for these unique holidays.

The thing of the sport is to get out of the rat race and onto the quick observe to wealth. The rat race is your job, the place you commerce your time for cash and are thus restricted by how a lot time there’s in a day. By the point you get to the quick observe, it’s your cash that’s incomes you more cash, not your time. One other nice lesson in economics.

To get out of the rat race, you could create extra passive earnings than your whole dwelling bills. Which is precisely how I retired early in actual life. That is the place the physician struggles to win the sport, as a result of she has greater bills than different professions, she must accumulate a higher quantity of passive earnings with a view to exit the rat race. So it’s advantageous for the physician to make strikes to reduce her dwelling bills by paying off debt and thus require a decrease whole of passive earnings to get out of the rat race.

As you go across the board you’ll go paydays, which is once you acquire your pay and pay your bills for the month. Similar to in actual life, each participant will get a special quantity on payday, based mostly on their occupation. You’ll be able to land on alternatives to speculate, market fluctuations, doodads to buy, probabilities to provide to charity for some further recreation advantages and the dreaded job downsize the place you lose your subsequent two turns and two month’s dwelling bills.

Similar to in actual life, there are massive offers and small offers to be made. An enormous deal is shopping for a 200 unit residence complicated. A small deal is shopping for a rental home or investing within the inventory market. Small offers will value as much as $5,000 to get into, such because the down cost on a small home. The massive offers start at $6,000 and go up from there.

Early within the recreation you’ll have much less cash and fewer belongings. So once you land on the chance house, you need to draw from the small deal card pile. A small deal may be the possibility to purchase a inventory, corresponding to OK4U Drug Firm which is promoting right now for $10 a share and normally trades between $5 and $40 a share. You should buy as a lot inventory in your flip as you want. If you wish to purchase an asset that prices greater than you’ll be able to afford with the money you’ve got acquired, the financial institution is completely happy to mortgage you cash at an rate of interest of 10% per pay interval. However be careful for going bankrupt.

Later within the recreation, playing cards drawn by any participant will create alternatives to promote the inventory at right now’s greater or cheaper price, or the inventory could also have a inventory break up, which is able to solely impact the individuals who personal that inventory. All through the sport, playing cards proceed to be drawn with the belongings promoting at completely different costs. Every participant should determine every time in the event that they need to purchase or promote at that value.

Small offers embrace a number of completely different sorts of shares and mutual funds, condos and homes for lease, gold cash, beginning an organization, certificates of deposit, uncooked land and others.

Later within the recreation when you’ve got accrued more cash and belongings, you’ll be able to start selecting from the massive deal card pile once you land on the chance house. Large offers value more cash up entrance and have bigger revenue prospects.

Large offers embrace bigger rental homes, small and enormous residence complexes, restricted partnerships, purchasing malls, laundromats, franchises, and enormous land for improvement offers.

Every deal is both a chance to extend your passive money movement or to promote your funding and purchase capital good points. It’s essential to consistently determine if you wish to take the capital good points and put money into one thing else or benefit from the money movement the property produces. It’s the money movement that wins the sport, however it’s the capital good points that generate sufficient money to purchase the massive offers that create greater money flows. The identical selections we face in our investing life.

With every deal, every participant will document the occasion on their earnings assertion. In the event that they purchased a rental home, they would want to pay the down cost and do the next calculations on their earnings assertion: Document the constructive money movement the property generates and calculate their new whole passive earnings which provides to their earned earnings creating a bigger payday. On their steadiness sheet they might document the asset worth, the down cost, and the quantity of the mortgage.

That is precisely what occurs in actual life when a rental home is bought. As they play the sport, they start to understand why one desires to personal rental actual property, shares and mutual funds.

When a participant pays off their money owed, they lower their bills which will get them nearer to exiting the rat race. However in addition they have to determine whether or not paying down a debt or shopping for one thing with a constructive money movement is the wiser transfer at that exact time within the recreation. At completely different instances within the recreation, every choice has completely different benefits. Whether or not to speculate or pay down debt is an actual life query I’m requested regularly. This recreation will assist give them a greater understanding of what’s going to occur after they select one of many choices. Possibly subsequent time they may select the opposite choice and examine their outcomes.

One house to land known as The Market, which simulates the ups and downs by means of which the actual market ebbs and flows. Relying on the state of affairs, one may need to money in on the shares they’ve bought and use the cash to purchase one thing that creates passive earnings. Some issues additionally happen through the recreation that may occur in actual life, like a tenant destroys your rental home or a brand new tax levy on all of your properties has been handed.

You additionally need to be careful for these doodad playing cards. These are issues we frequently purchase just because we need to, however they don’t produce any passive earnings. These embrace issues like school tuition or a daughter’s marriage ceremony (however these two solely apply when you’ve got a toddler), household holidays, massive display TVs, a go to with the dentist and the costliest of the doodads – a brand new boat. I’ve been there and that’s right, a ship is a gap within the water by which to throw cash. You higher actually like boating earlier than you selected to purchase a ship in actual life.

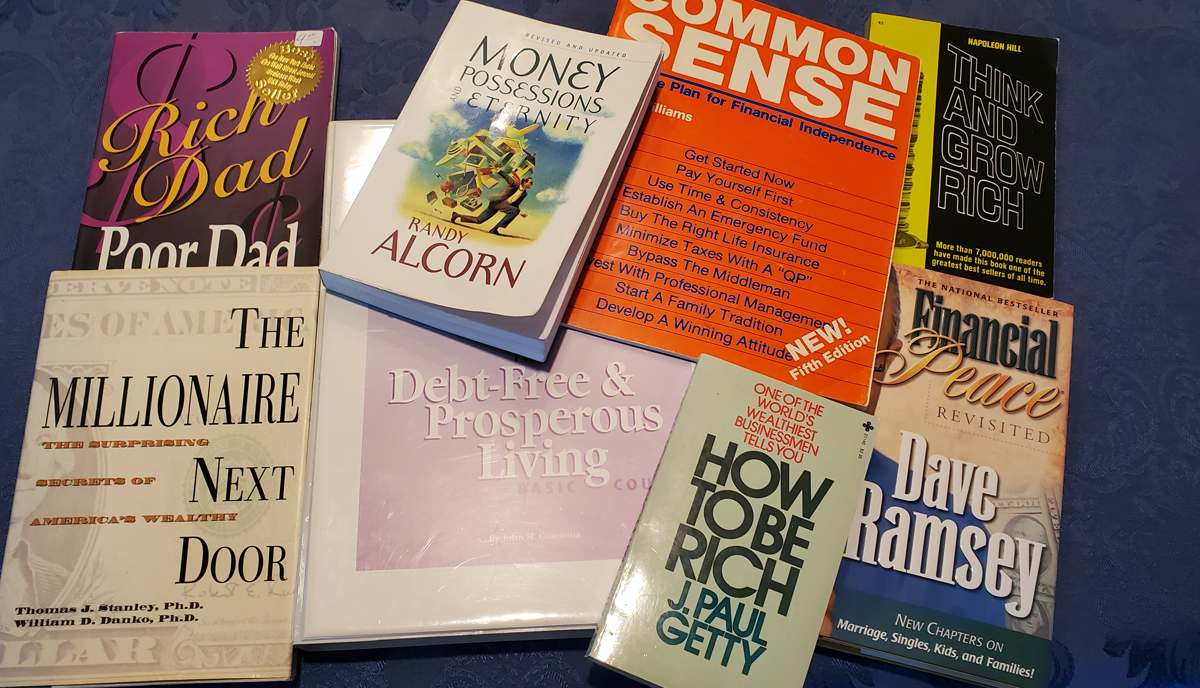

Our household nonetheless performs this recreation (we performed it final week as seen within the image) and I imagine it has contributed to my children’ good cash dealing with as younger adults. Of their late 20s they’re each debt free, began investing of their IRA’s and retirement accounts with their first job, and personal mortgage free money flowing rental properties.

If you wish to train your children about cash, get a replica of the sport Cashflow and begin taking part in it on recreation evening. Don’t have a household recreation evening? Properly then begin one, it’ll have many advantages that cash can’t purchase. Spending time with your loved ones is at all times a great funding.

Share this text: